vermont sales tax on alcohol

Are suitable for human consumption and. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Beer In Vermont Important To The Economy Arts And Entertainment Vtcng Com

Vermonts sin taxes cover alcohol and cigarettes.

. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. Alcoholic beverages subject to meals and rooms tax are exempt from sales and use tax. Sales up to 500000.

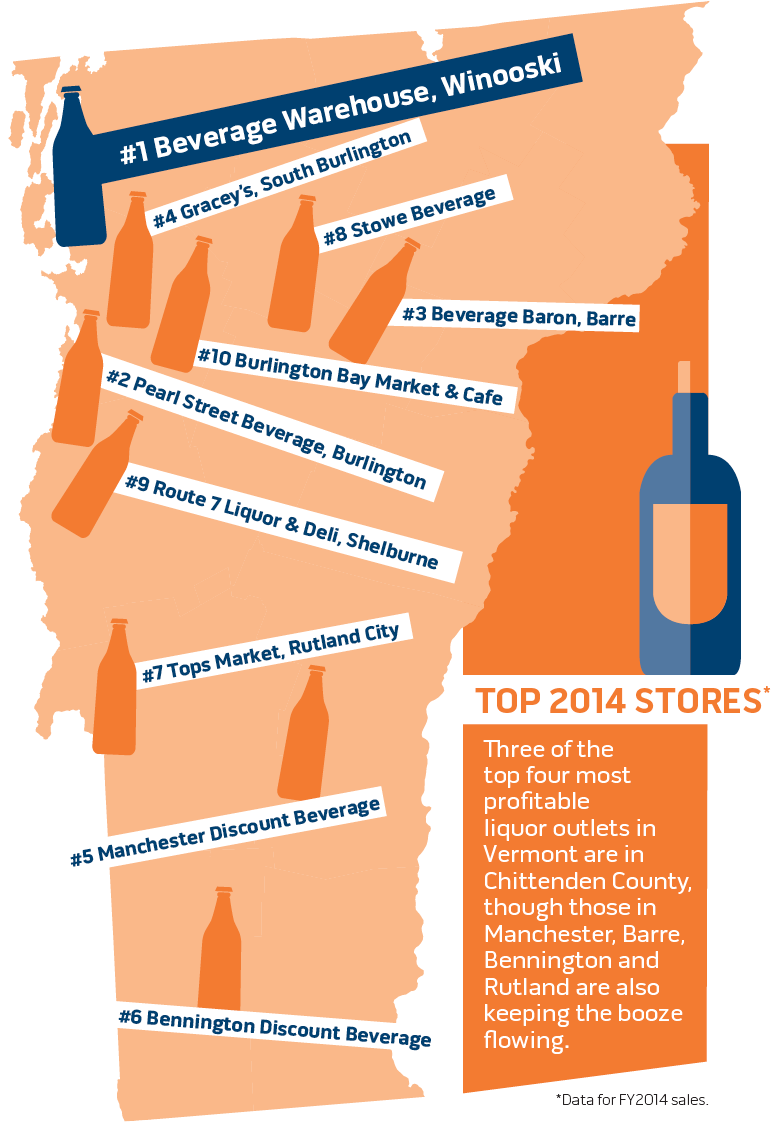

There are approximately 845 people living in the Manchester area. For those who sell beer cider RTD spirits beverages or wine to stores or restaurants. The Vermont Division of Liquor Control DLC was created in 1933 when the 21st Amendment to the US.

Constitution repealed the Volstead Act Prohibition. Local option tax does not apply to the sale or rental of motor vehicles which are subject to the motor vehicle purchase and use tax. Remember that zip code boundaries.

See our website at taxvermontgov for information related to the necessary forms and for due dates. O Includes sales from State liquor agents to bars and restaurants. Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that.

Local Option Sales Tax. An example of items that are exempt from Vermont sales. Beer over 6 percent alcohol by volume.

The Manchester Vermont sales tax rate of 7 applies in the zip code 05254. Control of the sale. PA-1 Special Power of Attorney.

Exemptions to the Vermont sales tax will vary by state. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. 974113 with the exception of soft drinks.

The tax on alcohol depends on the type and alcohol content of the beverage. Preliminary reports are created 75 days after the end of. Contain one-half of 1 or.

The Department of Taxes publishes Meals and Rooms Tax and Sales and Use Tax data by month quarter calendar year and fiscal year. According to a release from the. Additionally wholesalers must pay a tax on spirits and fortified wines as follows.

Vermonts excise tax on Spirits is ranked 15 out of the 50 states. W-4VT Employees Withholding Allowance Certificate. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. 1800 per 31-gallon barrel or 005 per 12-oz can. Federal excise tax rates on beer wine and liquor are as follows.

Alcoholic Beverage Sales Tax. 15th highest liquor tax. Such as gasoline or alcohol usually imposed on the producer or.

For those who supply spirits to the Vermont Division of Liquor Control. Summary of Vermont Alcoholic Beverage Taxes Beer and Wine Gallonage Tax 7 VSA. IN-111 Vermont Income Tax Return.

For beverages sold by. The state tax is 5125. 107 - 340 per gallon or 021 - 067 per 750ml bottle.

For beverages sold by holders of 1st or 3rd class liquor licenses. Sales and Use Tax. 2 of this Act approves a charter change for Barre City adding a 1 Local Option Tax for sales to the existing Local Option Taxes for rooms meals and alcoholic.

Are excise taxes included in the Vermont sales tax basis.

How High Are Spirits Excise Taxes In Your State

A Toast To Utah Liquor Dollars They Topped A Half Billion For First Time

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Sales Tax Small Business Guide Truic

Vermont Alcohol Laws Deny Religious Freedom Learn Them Here

Liquor Taxes How High Are Distilled Spirits Taxes In Your State

Sales And Excise Taxes Minnesota Beer Wholesalers Assocation

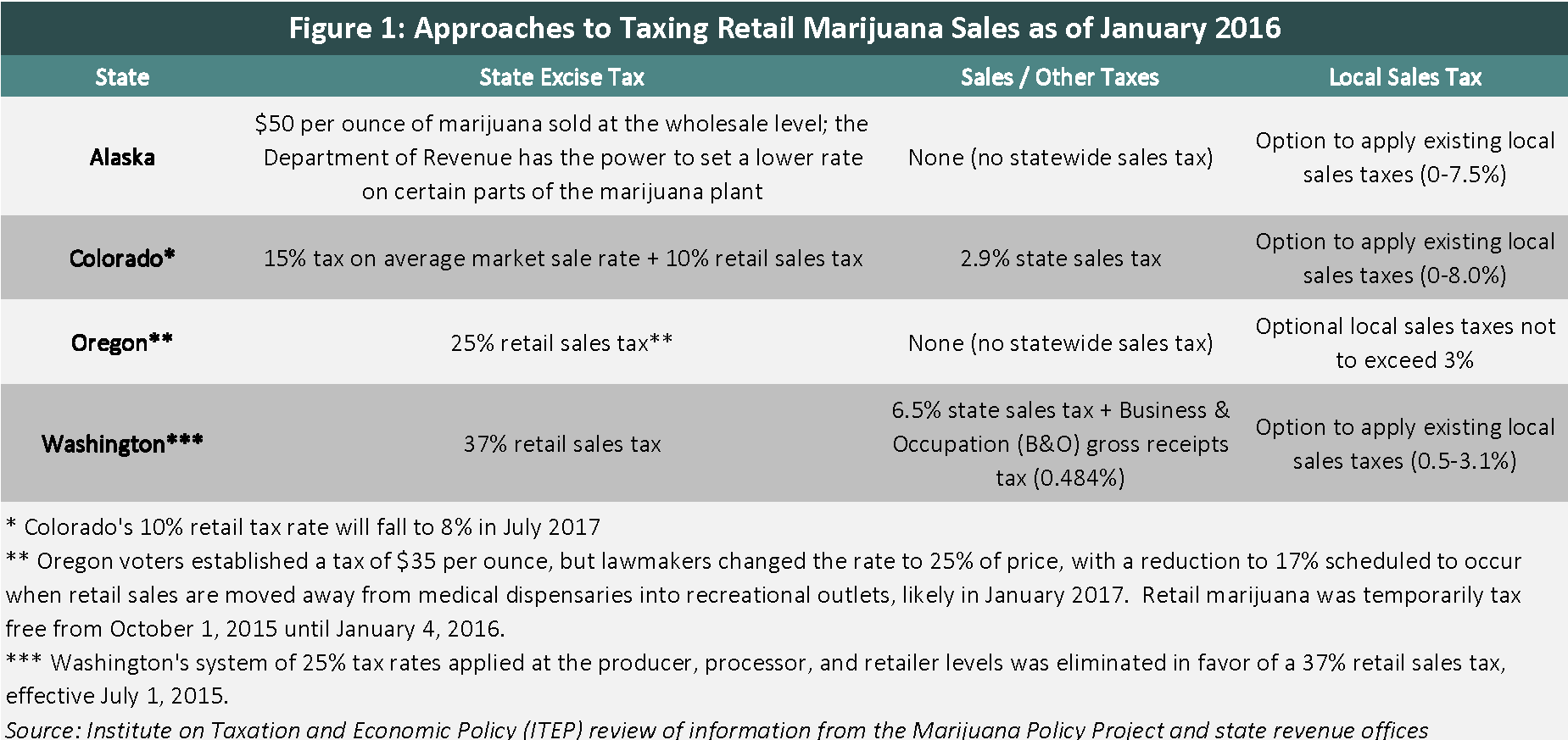

Testimony Before The Vermont Senate Committee On Finance Tax Policy Issues With Legalized Retail Marijuana Itep

Liquor Taxes State Distilled Spirits Excise Tax Rates Tax Foundation

Liquor Licenses Morristown Vermont

Printable Vermont Sales Tax Exemption Certificates

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Beverage Warehouse Vermont S Largest Craft Beer Wine Liquor Store

Marijuana Taxes How To Do It Conversable Economist

State Liquor Tax Rates Are Stuck In The Mud Tax Policy Center

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Bottle Racket Illinois High Alcohol Taxes Blow Up Cost Of Independence Day Celebrations